#StockMarket #S&P500 #InvestorSentiment

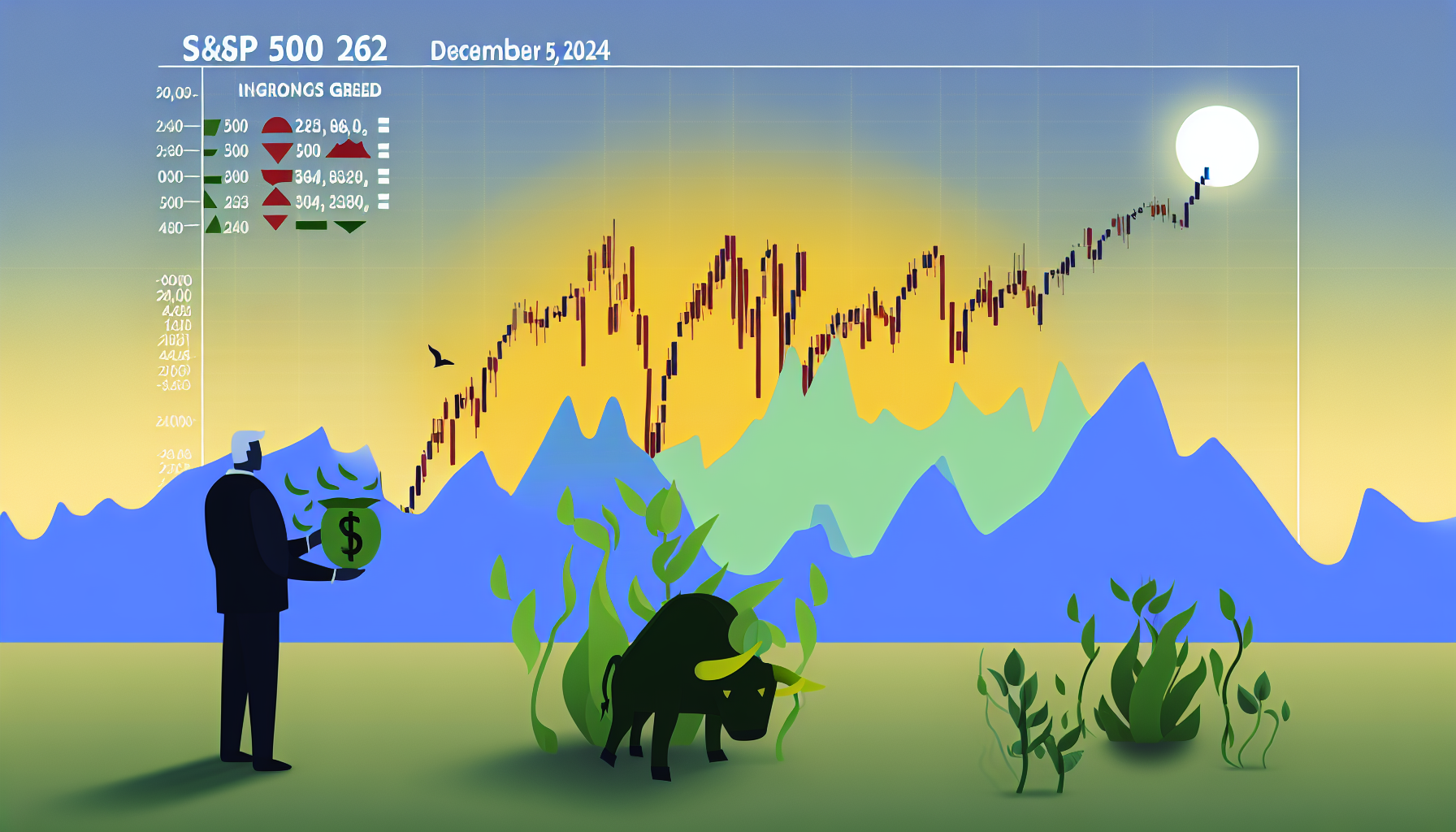

Stock Market Analysis for December 5, 2024: A Day of Renewed Optimism and Record Highs

As the final month of the year unfolds, the stock market is once again demonstrating its traditional strength, a phenomenon that has been a hallmark of December for many years. Today, December 5, 2024, was no exception, with key indices surging to fresh record highs and investor sentiment tilting firmly towards greed.

Market Performance

The S&P 500 Index, a bellwether for the broader market, closed at a new record high, marking a 0.61% gain for the day. This move was part of a larger trend that has seen the index chart higher highs and higher lows since the double-bottom support at 5850 on November 19th. The S&P 500 now stands at 6,049.87, with its 20-day moving average providing solid support at 5977[1][2].

The Nasdaq, often a leader in tech-driven rallies, outperformed other major indices with a 1.29% gain, closing at 19,480.91. This robust performance was driven by positive comments from Federal Reserve Chair Jerome Powell on the U.S. economy, which bolstered investor confidence across the board[4].

The Dow Jones Industrial Average, though slightly lagging behind its peers, still managed a respectable 0.70% increase, ending the day at 44,705.54. This collective upward momentum underscores the market's current bullish trajectory[2][4].

Investor Sentiment and Fear and Greed Index

The Fear and Greed Index, a valuable tool for gauging market sentiment, stands at 59, firmly in the "Greed" territory. This reading indicates that investors are currently more inclined towards buying than selling, reflecting a high level of optimism in the market. The index combines various indicators such as price momentum and market volatility to provide a snapshot of investor emotions, which is crucial for making informed investment decisions[3].

This sentiment is further reinforced by the technical indicators. Major moving averages are all pointing higher, and momentum indicators continue to hover above their middle lines, characteristic of a strong bullish trend. This alignment suggests that the market is well-positioned for continued strength, particularly as the year-end approaches, a period historically known for its bullish tendencies[1].

Economic and Geopolitical Factors

Today's market activity was also influenced by several economic and geopolitical developments. Federal Reserve Chair Jerome Powell's positive remarks on the U.S. economy provided a significant boost to the markets. His comments helped in pricing in a potential 25-basis-point rate cut by the Fed, leading to a decline in Treasury yields. The 2-year yield dropped by 2.4 basis points to 4.127%, while the 10-year yield fell by 1.5 basis points to 4.184%[4].

In the currency markets, volatility persisted due to geopolitical tensions. The Euro experienced a sharp decline following the confirmation of a French government collapse but later recovered. The DXY (Dollar Index) closed the day down 0.10% at 106.32, reflecting the ongoing geopolitical uncertainties[4].

Upcoming Economic Data

As we move forward, several key economic data points will be closely watched. Tomorrow’s highly anticipated Non-Farm Payrolls (NFP) report is expected to be a major market mover. Today, weekly unemployment claims are scheduled for release, with a forecast of 215,000. Additionally, Canada’s Ivey PMI figures will be released, providing further insights into economic health[4].

Global Market Overview

The global market landscape also saw significant movements. The UK markets will be in focus during the European open with the release of Construction PMI data, forecasted to be at 53.5. In Asia, the session is expected to be relatively quiet due to a sparse economic calendar. However, indices such as the Nifty 50 and S&P BSE SENSEX in India closed with gains of 0.75% and 0.74%, respectively, reflecting the broader global optimism[2][4].

Technical Analysis and Seasonal Trends

From a technical standpoint, the market's current configuration is highly favorable. The S&P 500’s ability to hold above its 20-day moving average and the overall trend of higher highs and higher lows are strong indicators of a bullish trend. Intermediate-term analysis shows greater evidence of support than resistance, setting the stage for year-end strength that is typically seen in the markets[1].

Seasonally, December is one of the strongest months for stocks, with the S&P 500 averaging a 1.2% gain over the past few decades. This historical trend, combined with the current technical and fundamental analysis, suggests that the market is well-positioned for continued gains as the year draws to a close[1].

Conclusion

In conclusion, December 5, 2024, was a day marked by renewed optimism and record highs in the stock market. Driven by positive economic commentary from the Federal Reserve and supported by favorable technical indicators, the market continues to exhibit strong bullish characteristics. As we navigate the final month of the year, investors should remain vigilant but also prepared to capitalize on the traditionally strong seasonal trends that often accompany this period.

The alignment of investor sentiment, as reflected by the Fear and Greed Index, with the technical and fundamental analysis of the market, paints a compelling picture of a market poised for further gains. As always, it is crucial to stay informed and adapt to evolving market conditions, but for now, the signs are clear: the stock market is in a bullish mode, and December is shaping up to be a strong month.

Leave a Reply